In a losing scenario, the stock takes a hit and the share price drops from $30 to $20. The value of her investment falls from $6,000 to $4,000, and after she repays the loan, she has just $1,000 — a $2,000 loss. Had she invested with only her cash, her losses would only be half that, at $1,000. Our partners cannot pay us to guarantee favorable reviews of their products or services. It’s a marker of your profitability, stability, and how attractive you are to investors. You can also use it to understand how you compare with the competition, and evaluate whether your business model is sustainable.

Other factors can play a part in deciding the margin rate as well, such as how much money you have in your margin account. The more you invest, the less your margin rate may be, depending on the brokerage you are working with. Arrived Homes allows retail investors to buy shares of individual rental properties for as little as $100. When the time is right, Arrived Homes sells the property so investors can cash in on the equity they’ve gained over time.

Understanding Net Profit Margin

Adjustable-rate mortgages (ARM) offer a fixed interest rate for an introductory period of time, and then the rate adjusts. To determine the new rate, the bank adds a margin to an established index. In most cases, the margin stays the same throughout the life of the loan, but the index rate changes. To understand this more clearly, imagine a mortgage with an adjustable rate that has a margin of 4% and is indexed to the Treasury Index. If the Treasury Index is 6%, the interest rate on the mortgage is the 6% index rate plus the 4% margin, or 10%. The Securities and Exchange Commission has stated that margin accounts “can be very risky and they are not appropriate for everyone”.

- “Margin accounts can be very risky and they are not appropriate for everyone,” the Securities and Exchange Commission warns in its guide for investors.

- Let’s say an investor wants to purchase 200 shares of a company that’s currently trading for $30 a share, but she only has $3,000 in her brokerage account.

- There are no guarantees that working with an adviser will yield positive returns.

- Typically, margin rates are 3% to 12% of the notional value of the contract.

- Margin trading involves significantly higher risk than investing with cash.

In order to calculate it, first subtract the cost of goods sold from the company’s revenue. This figure is known as the company’s gross profit (as a dollar figure). Then divide that figure by the total revenue and multiply it by 100 to get the gross margin. Gross margin and gross profit are among the different metrics that companies can use to measure their profitability. Both of these figures can be found on corporate financial statements, notably a company’s income statement. Although they are commonly used interchangeably, these two figures are different.

For example, it is used as a catch-all term to refer to various profit margins, such as the gross profit margin, pre-tax profit margin, and net profit margin. The term is also sometimes used to refer to interest rates or risk premiums. When you take out a loan from your broker to buy on margin, the loan is secured with the investments you buy—similarly to how you secure a home equity line of credit (HELOC) with the home itself. Regulations limit investors to borrowing up to 50% of an investment’s purchase price. Brokerages may have other limitations on how much you can borrow for margin trading.

Use of Brex Empower and other Brex products is subject to the Platform Agreement. As a rule of thumb, 5% is a low margin, 10% is a healthy margin, and 20% is a high margin. But a one-size-fits-all approach isn’t the best way to set goals for your business profitability. Each of these three formulas provides unique insight into your financial health, and helps you make informed business decisions. Diversification strategies do not ensure a profit and do not protect against losses in declining markets. If you decide margin is right for your investing strategy, consider starting slow and learning by experience.

Is Tesla’s Operating Margin Headed to 0%?

Setting the right price for products or services can directly affect profit margins. Overpricing may deter customers, while underpricing, even with increased sales, might lead to slimmer margins. Margin trading, or “buying on margin,” means borrowing money from your brokerage company, and using that money to buy stocks.

Typically, margin rates are 3% to 12% of the notional value of the contract. The most comprehensive of the three is net profit margin, which factors in every expense. Subtract all expenses — including taxes and interest — from total revenue, then divide by total revenue. That means the value of her initial $6,000 investment grew to about $8,000. Even though she has to return the borrowed money, she gets to keep the gains it helped her achieve. In this case, after she returns the $3,000, she’s left with $5,000 — a $2,000 profit.

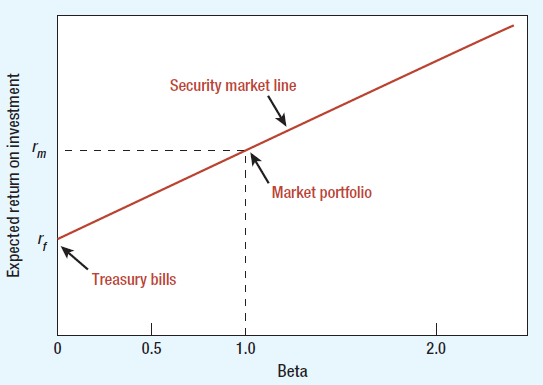

Profit margins are one of the simplest and most widely used financial ratios in corporate finance. A company’s profit is calculated at three levels on its income statement. This most basic is gross profit, while the most comprehensive is net profit. All three have corresponding profit margins calculated by dividing the profit figure by revenue and multiplying by 100. Gross profit margin is your profit divided by revenue (the raw amount of money made). Net profit margin is profit minus the price of all other expenses (rent, wages, taxes, etc.) divided by revenue.

How often should businesses review their profit margins?

If the stock appreciates to $10 per share, the investor can sell the shares for $10,000. If they do so, after repaying the broker’s $2,500, and not counting the original $2,500 invested, the trader profits $5,000. For example, if a company generates $1,000 in revenue and has $800 in expenses, its profit is $200. By offering a clear snapshot of profitability, this percentage gauges the green shoe financial health of a company and helps in comparing its performance against competitors or industry benchmarks. An investor may also choose to make interest payments to the brokerage instead of having the interest deducted from their margin account. If the investor does not pay off the loan and the required interest on time, the debt and interest charges will accumulate over time.

If the securities decline in value, the investor will be underwater and will have to pay interest to the broker on top of that. But with margin trading, you can’t always just wait out dips in the stock market. If the stock price falls and your equity dips below the minimum margin trading requirement, you’ll need to add more capital or risk having some of your securities sold at a serious loss. Depending on your brokerage account type and balance, you may have the ability to do margin trading — or leverage your capital, as the pros call it. Why do investors borrow money to buy stocks, bonds or ETFs in the first place?

EBITDA margin

Calculating gross margin can show you if you’re spending too much time or labor on a certain product or service. In business accounting, margin refers to the difference between revenue and expenses, where businesses typically track their gross profit margins, operating margins, and net profit margins. The gross profit margin measures the relationship between a company’s revenues and the cost of goods sold (COGS).

Acacetin Market 2023-2031 Market Insight: by Recent Developments and Gross Margin with 106 Pages – Benzinga

Acacetin Market 2023-2031 Market Insight: by Recent Developments and Gross Margin with 106 Pages.

Posted: Wed, 13 Sep 2023 05:58:18 GMT [source]

It can refer to the difference between the cost of a product and how much you sell it for. It can also mean the amount by which revenue from total sales exceeds costs in a business. The most significant profit margin is likely the net profit margin, simply because it uses net income. The company’s bottom line is important for investors, creditors, and business decision-makers alike. This is the figure that is most likely to be reported in a company’s financial statements. That’s because profit margins vary from industry to industry, which means that companies in different sectors aren’t necessarily comparable.

Phrases Containing margin

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Neither Schwab nor the products and services it offers may be registered in your jurisdiction. Neither Schwab nor the products and services it offers may be registered in any other jurisdiction. Its banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an Equal Housing Lender), provides deposit and lending services and products.

There is also a minimum amount that has to be on the account, which is called the maintenance margin. It’s currently set to 25% of the total value of the securities by the Federal Reserve Board, but some brokerages may require it to be higher. The gross profit margin shows how much the business makes after subtracting the cost of the goods sold. The word ‘margin’ has several meanings, both in the world of business and finance, as well as other situations.

The investor has the potential to lose more money than the funds deposited in the account. For these reasons, a margin account is only suitable for a sophisticated investor with a thorough understanding of the additional investment risks and requirements of trading with a margin. But provided that you fully understand the risks and costs, margin trading could increase your profits and return on your investments. It can allow you to invest in a greater range of securities, too. A margin rate refers to the cost of the money that you borrow from a broker to buy stocks. Though new investors may sometimes find themselves having to pay a margin rate, it is generally the providence of professional stock traders and sophisticated investors.

It represents the profit generated after accounting for the expenses. When it comes to finances, the meaning of a margin is very different. It represents security collateral the investor must deposit before borrowing money from the broker or exchange for stock trading.

By contrast, operating expenses refer to the costs that keep your business up and running. This category includes items like rent, payroll, marketing, and inventory software. Alternatively, it may decide to increase prices, as a revenue-increasing measure. Gross profit margins can also be used to measure company efficiency or to compare two companies of different market capitalizations. Operations-intensive businesses such as transportation, which may have to deal with fluctuating fuel prices, drivers’ perks and retention, and vehicle maintenance, usually have lower profit margins. If the investor fails to maintain the minimum maintenance margin, the brokerage will make a margin call.

Since margin calls can occur when markets are volatile, you may have to sell securities to meet the call at lower than expected prices. During steep market declines, clients are forced to sell stocks to meet margin calls. This can lead to a vicious circle, where intense selling pressure drives stock prices lower, triggering more margin calls and more selling. A margin call is issued by the broker when there is a margin deficiency in the trader’s margin account. To rectify a margin deficiency, the trader has to either deposit cash or marginable securities in the margin account or liquidate some securities in the margin account. Margin trading involves significantly higher risk than investing with cash.

Therefore, after subtracting its COGS from sales, the gross margin is $100,000. A net profit margin of 23.7% means that for every dollar generated by Apple in sales, the company kept just shy https://1investing.in/ of $0.24 as profit. Profitability metrics are important for business owners because they highlight points of weakness in the operational model and enable year-to-year performance comparison.

It may limit the investor’s ability to earn enough returns in the future. Margin accounts are used as short-term investments that investors can use to profit from short-term security movements rather than long-term investments. The investor can then start using the account for share trading and can borrow up to 50% of the capital required to purchase a security.

In addition to keeping adequate cash and securities in their account, a good way for an investor to avoid margin calls is to use protective stop orders to limit losses in any equity positions. If you’re thinking about margin trading anyway, you need to make sure you have enough cash on hand to cover any potential losses if your investments fall in value. Otherwise, your investments could be liquidated, and you could lose a significant amount of money. If you had purchased $5,000 worth of stock in cash—no margin involved—and the stock suffered the same decline, you’d only lose $1,000 or 20%.

The FRB also regulates which companies can be traded using this system. While a common sense approach to economics would be to maximize revenue, it should not be spent idly — reinvest most of this money to promote growth. Pocket as little as possible, or your business will suffer in the long term! Profit margin often comes into play when a company seeks funding. Smaller businesses, like a local retail store, may need to provide it for seeking (or restructuring) a loan from banks or other lenders. Without buying on margin he may have still lost a fair amount of money in the downturn, but “by overleveraging myself … that’s why my losses were significantly amplified,” he says.